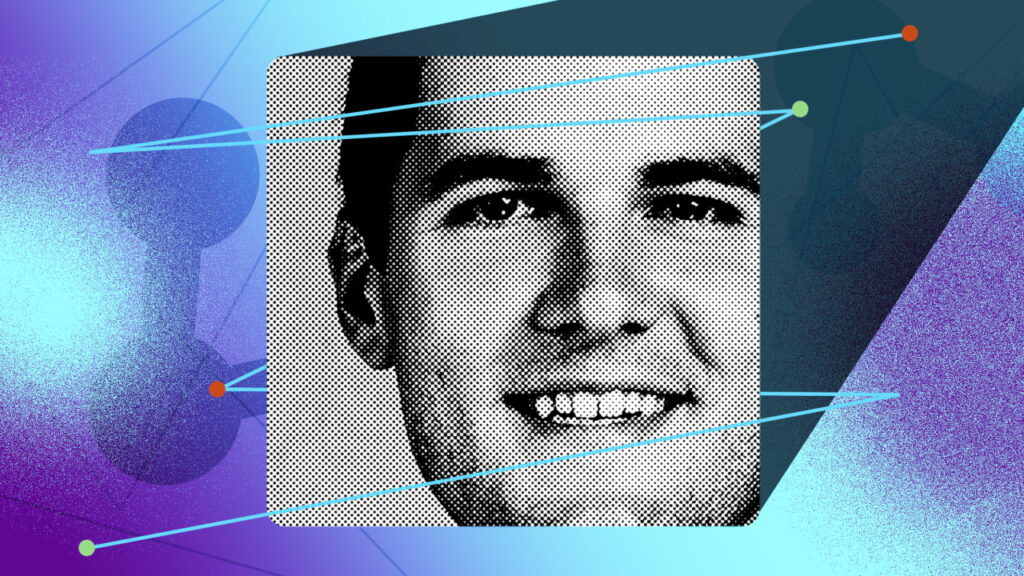

“We’re on this huge paradigm shift,” says Vince Hankes, the enterprise capitalist main Thrive Capital’s funding in OpenAI. “And when that occurs, traditionally, there have been new corporations created which might be price some huge cash.”

Thrive Capital wasn’t an early investor within the generative AI standout—it didn’t purchase in till 2023—nevertheless it’s made a number of the greatest bets on the startup. It reportedly led a private share deal in early 2024 that enabled OpenAI workers to promote shares at an $86 billion valuation, then led a funding spherical in October that valued the startup at $157 billion.

Hankes and Thrive’s founder Josh Kushner (brother of President-elect Donald Trump’s son-in-law Jared Kushner) had identified Sam Altman for years earlier than investing. However it was really their curiosity in different corporations that introduced them to OpenAI. “We really have been different startups utilizing this AI know-how and it turned out to be GPT-3 below the hood,” Hankes says. “And that spurred us to go spend time with OpenAI, which again then was far more of an enigma, I feel, to the common investor.”

For AI corporations like OpenAI, success is a sport of scale: Constructing giant frontier models requires huge quantities of coaching information and computing energy. That type of scale requires giant funding rounds and lengthy runways, with the potential for very huge paydays down the road. As an investor, Thrive is ready up for such delayed gratification, in response to Hankes, who labored at Tiger World earlier than turning into a accomplice at Thrive in 2019.

“[We] don’t do many issues, however once we do one thing, we’re getting enthusiastic about a chance [and] we actually double, triple, quadruple down by way of our time making an attempt to grasp it very deeply,” he provides.

Hankes believes OpenAI is one in all a comparatively small set of corporations (alongside the likes of Meta, Google, and Anthropic) that can have the assets to construct the frontier fashions of the long run. However even amongst that crowd, he believes the startup has some distinctive aggressive benefits. He says OpenAI “captured the zeitgeist of the market” with ChatGPT, which has translated into tens of millions of paying ChatGPT Pro subscribers. That income might help offset the prices of inventing and coaching new frontier fashions. CFO Sarah Friar just lately mentioned OpenAI now makes 75% of its income from its 11 million ChatGPT Professional prospects.

OpenAI additionally will get worthwhile information from its chatbot customers’ conversations (offered they choose in), which the corporate can then use to assist prepare the following technology of its frontier fashions. This creates a flywheel impact, Hankes says.

“As they try this they get new capabilities and options, which attracts extra customers,” he says.

This story is a part of AI 20, our monthlong collection of profiles spotlighting essentially the most attention-grabbing technologists, entrepreneurs, company leaders, and inventive thinkers shaping the world of synthetic intelligence.