Unlock the White Home Watch e-newsletter free of charge

Your information to what the 2024 US election means for Washington and the world

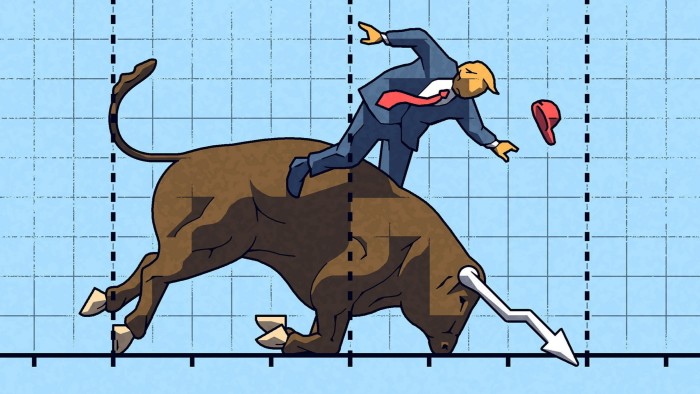

Name me a Cassandra. Many have. However I’m already dreading the downturn that should absolutely come sooner or later throughout Donald Trump’s presidency. Sure, the short-term sugar excessive of deregulation and tax cuts is already upon us. However, judging by historical past, the US is means overdue for each a recession and an enormous market correction, and the danger vectors in play with Trump make it extra seemingly.

Why ought to I be so detrimental, so early? One can simply argue that there are lots of causes to be optimistic that the sturdy financial system President Joe Biden constructed and Trump will inherit will proceed to increase. There’s constructive actual earnings development in the mean time, plus productiveness enhancements, an anticipated restoration in world manufacturing and price cuts, after all.

Add to that issues resembling the approaching Trump deficit spending, and the roll again of Biden’s antitrust insurance policies, which is able to absolutely imply a increase in mergers and acquisitions, and you’ve got an excellent case for one more 12 months or two of positive factors in US property. This appears significantly so in areas like expertise, finance (banks are gearing up for all that dealmaking), crypto (each time the billionaire investor Elon Musk tweets about Dogecoin it will get a lift), personal fairness and personal credit score.

And but, even when the Democrat Kamala Harris had gained the White Home, I’d be pondering fastidiously about what’s actually driving this market. As TS Lombard mentioned in a current notice to purchasers, “this enterprise cycle has all the time appeared ‘synthetic’, and it has been powered by a sequence of short-term or one-off forces, resembling pandemic reopening, fiscal stimulus, extra financial savings, revenge spending and extra lately [higher] immigration and labor pressure participation”.

Certainly, one may argue that the market atmosphere of the previous 40 years, with its pattern of falling rates of interest and big bouts of financial stimulus and quantitative easing after the nice monetary disaster, is synthetic. We’ve a technology of merchants who do not know what a really excessive rate of interest atmosphere seems like. The minute charges went up even just a bit bit just a few years again, you noticed the dominoes fall — contemplate Silicon Valley Bank’s bailout or the surge in bond yields throughout the disaster that ended Liz Truss’s very temporary stint as prime minister.

Whereas I don’t truly suppose that Trump goes so as to add gas to any inflationary hearth with huge across-the-board tariffs (the Wall Road contingent of his administration wouldn’t countenance the market collapse that may consequence), you’ll in all probability see him use the US client market as a sort of chit to be traded for varied financial and geopolitical positive factors. Germany not falling in keeping with America’s China coverage? How about greater tariffs on European autos? This sort of dealmaking is itself dangerous.

I very a lot doubt whether or not Trump will deport tens of millions of migrants, as he has promised to do; once more, the Wall Road crowd will push again on the inflationary results. However this elementary pressure between what the Maga crowd desires, and what personal fairness and Huge Tech need, is itself a hazard. It can inevitably create factors of instability and unpredictability that will transfer the markets a method or one other.

Sudden coverage divergences may simply mix with among the extra ordinary sources of monetary threat to create an enormous market occasion.

Extremely leveraged loans and personal fairness investments are a hazard after all, on condition that Trump will in all probability roll again an already lax regulatory atmosphere at a time when these property have gotten a much bigger a part of the portfolios of pensions and retail traders.

This, coupled with an anticipated scaling again of financial institution capital will increase, is among the issues that has Higher Markets president Dennis Kelleher nervous. “I feel we’ll get a two-year sugar excessive underneath Trump however down the highway, we’re a probably catastrophic correction — one thing a lot worse than [the financial crisis of] 2008. That’s as a result of we’ve got a monetary system that’s primarily extractive.”

Crypto is one other potential set off. It could haven’t any inherent worth, however Columbia College legislation professor Jeffrey Gordon worries that as real-world property and liabilities are more and more denominated in crypto, it can have a channel into the true financial system. “Stablecoins can dive considerably under par,” Gordon says. “We’ve seen this film earlier than, with prime cash market funds.”

But when there’s a liquidity disaster in crypto, there isn’t any lender of final resort. You’d simply see numerous imaginary worth disappear, leaving real-world collateral calls and financing shortfalls.

I’d put Musk himself up there as one other monetary threat issue. The electrical-car maker Tesla is on a tear due to the tech titan’s relationship with Trump. However sooner or later, the markets are going to understand that China could make its personal electrical autos for much lower than Tesla can. Past that, US-China tensions could but affect on Musk’s capacity to make inexperienced automobiles in China. I’d even be shocked if the massive American oil barons, who’re the true muscle within the Republican get together, didn’t push again in opposition to Musk’s affect. Both means, Tesla’s inventory value may take an enormous hit, and drag down the bigger froth in areas resembling synthetic intelligence with it.

As somebody nonetheless closely invested in US shares, I’m not wishing for any of this to occur. However I wouldn’t low cost it both. Washington lately has a really roaring 20s vibe.