Keep knowledgeable with free updates

Merely signal as much as the UK inflation myFT Digest — delivered on to your inbox.

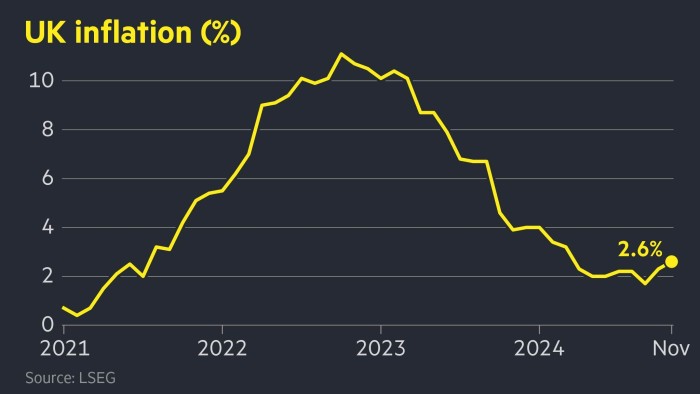

UK inflation accelerated to 2.6 per cent in November, highlighting the Financial institution of England’s problem because it grapples with persistent worth pressures and a stagnating financial system.

The rise within the shopper worth index was in keeping with the expectations of economists and above the 2.3 per cent recorded in October. Increased costs for motor fuels and clothes helped push inflation larger, in response to figures from the Workplace for Nationwide Statistics on Wednesday.

The rise comes forward of a gathering of the BoE’s Financial Coverage Committee on Thursday at which it’s broadly anticipated to carry rates of interest at 4.75 per cent, after lowering borrowing prices twice this 12 months.

GDP has shrunk for 2 consecutive months, whereas enterprise surveys level to weaker confidence and curtailed hiring intentions following Rachel Reeves’ tax-raising Price range in October. However a pick-up in UK wage growth has quashed hopes of an rate of interest minimize on the BoE’s last assembly of the 12 months.

November’s determine “extinguishes any lingering hopes of an rate of interest minimize on Thursday, whereas considerations over mounting inflation dangers, together with the latest spike in pay progress, imply {that a} February loosening will not be a carried out deal,” mentioned Suren Thiru, economics director at accountants’ physique the ICAEW.

Following the discharge of the info, sterling edged down 0.1 per cent to $1.269. Buyers have all however dominated out the prospect of an rate of interest minimize on Thursday, in response to ranges implied by swaps markets, and count on simply two reductions subsequent 12 months.

Core inflation, which excludes power, meals, alcohol and tobacco, was 3.5 per cent in November, the ONS information confirmed, above the three.3 per cent recorded in October.

Providers inflation, carefully watched by the central financial institution as a gauge of underlying home worth pressures, was 5 per cent in November, matching October’s determine however under analysts’ expectations of 5.1 per cent.

Governor Andrew Bailey has mentioned the BoE will proceed to ease coverage steadily however officers have pointed to the persistence of companies inflation as a purpose for warning.

Clare Lombardelli, the deputy governor, told the Monetary Occasions in November that she was fearful companies worth inflation had continued to be “effectively above” charges in step with the BoE’s 2 per cent goal.

The November companies worth studying was barely forward of the BoE’s personal 4.9 per cent forecast.

Inflation has fallen sharply from a peak of 11.1 per cent in October 2022, however the BoE now faces an uptick at a time of accelerating pressure for the financial system.

In addition to indicators that the Price range has had a chilling impact on firms’ hiring plans, the BoE has mentioned it’s assessing whether or not the rise in nationwide insurance coverage contributions paid by firms introduced by Reeves will add to inflationary pressures.

Following the discharge of November’s inflation figures, Reeves mentioned: “I do know households are nonetheless struggling with the price of dwelling and as we speak’s figures are a reminder that for too lengthy the financial system has not labored for working individuals.”