Unlock the Editor’s Digest totally free

Roula Khalaf, Editor of the FT, selects her favorite tales on this weekly e-newsletter.

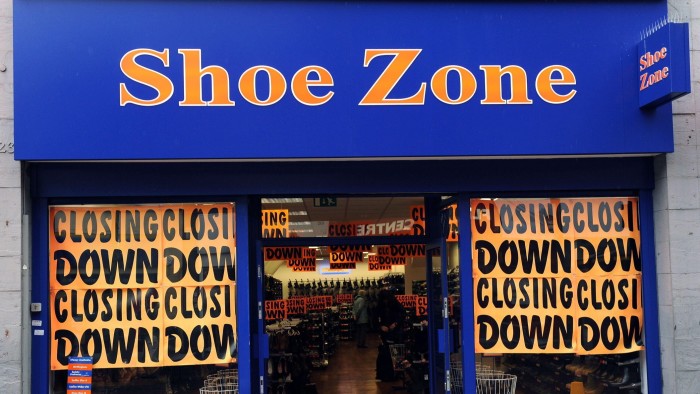

British footwear chain Shoe Zone has blamed additional prices arising from the current UK Budget for its choice to close outlets because it warned on earnings and suspended its dividend, sending shares within the firm down nearly 40 per cent.

The Intention-listed group, which has 297 shops and employs about 2,250 workers throughout the nation, stated in an unscheduled replace to buyers on Wednesday that further prices referring to will increase in employers’ nationwide insurance coverage and the nationwide residing wage “have resulted within the deliberate closure of a variety of shops which have now change into unviable”.

It stated it has been dealing with “very difficult circumstances” and weaker shopper confidence since chancellor Rachel Reeves unveiled the modifications in October.

Shoe Zone now anticipated adjusted revenue earlier than tax to be no less than £5mn for the 12 months to September 27 2025, down from earlier expectations of £10mn. It might not pay a ultimate dividend for 2024, it added.

The shares closed down in London buying and selling by 39.1 per cent, to 84.2p, giving it a market capitalisation of about £40mn.

Nick Bubb, an unbiased retail analyst, stated Shoe Zone’s revenue warning “may rattle a number of nerves within the sector”.

UK retailers final month collectively warned of annual prices of as much as £7bn following the Price range, in addition to job losses, store closures and better costs.

Giant employers similar to Tesco, Subsequent and Marks and Spencer all signed a letter to the Chancellor saying that “the impact can be to extend inflation, sluggish pay development, trigger store closures, and cut back jobs, particularly on the entry degree”.

Nevertheless, Russ Mould, funding director at AJ Bell, wrote in a observe that “Shoe Zone placing the blame for a significant revenue warning on the Price range appears a poor match” as shopper confidence has ticked up in current weeks for the reason that Price range.

He added: “Poor autumn climate gained’t have helped however Shoe Zone doesn’t promote a discretionary product — it sells reasonably priced footwear, for which demand ought to be comparatively resilient.

“Maybe Shoe Zone’s providing isn’t resonating with buyers as a lot because it used to.”

The Treasury has beforehand stated: “With our public companies crumbling and a £22bn fiscal black gap we needed to make tough selections to repair the foundations of the nation and restore desperately wanted financial stability. This was a as soon as in a parliament funds to wipe the slate clear.”