Kwara Inside Income Providers has debunked the alleged victimisation of Igbo enterprise homeowners within the state over noncompliance with tax fee legal guidelines.

The clarification was contained in a press assertion signed by the Head, Company Affairs of the company, Funmilola Oguntunbi, and made obtainable to the press in Ilorin, the state capital on Saturday

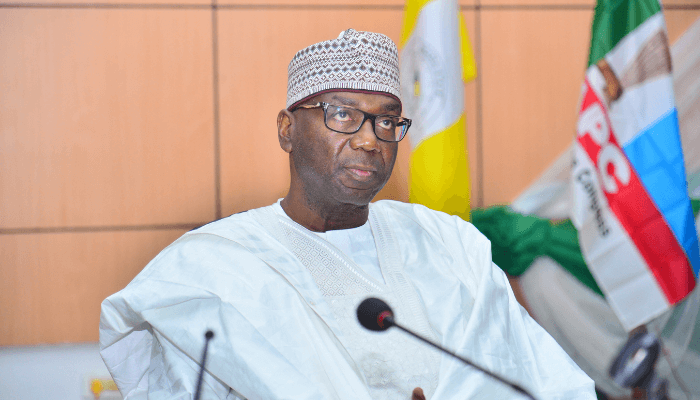

The company defined that the alleged victimisation of Igbo merchants by the company printed by a web-based platform (not PUNCH On-line) in opposition to the character of the state governor, Mallam AbdulRaman AbdulRazaq and KW-IRS was a falsehood that focused ethnic sentiment to achieve undue public sentiment.

The assertion learn, “The eye of the Service has been drawn to a false, malicious, and inciting publication on thirty first July 2024 by one on-line publication, Worldwide Centre for Investigative Reporting, in opposition to the character of the Governor of Kwara State and the Kwara State Inside Income Service respectively.

“We’re tempted to consider that this false narrative was on the occasion of some members of the Kwara State Igbo Merchants Affiliation (KWAITA), which has just lately instituted a authorized motion in opposition to the Service on twelfth July 2024 on the identical material earlier than the Kwara State Excessive Court docket.

“In swimsuit KWS/308/24 – NWANKWO SYLVESTER & 90 ORS VS KWARA STATE INTERNAL REVENUE SERVICE & 2 ORS. This motion of twisting the info by means of a media publication is, due to this fact, in unhealthy religion.

”In response to the deliberate misinformation, we make clear as follows: Opposite to the unfounded allegation contained within the publication, at no time did the Governor of Kwara State explicitly or impliedly direct the Service to victimise or act in a specific means in direction of anybody primarily based on their faith, ethnicity, or different private social id.”

Whereas sustaining that the execution of tax judgment in opposition to merchants within the state was non-discriminatory, KW-IRS mentioned, “the execution of judgments was effected on six judgment debtors/taxpayers. Three of them are Igbo merchants, whereas the remaining three are Yoruba merchants.”

The judgment on debtors, in response to the company included, “Electrical home equipment, Boutique sellers and a vendor in Vehicle spare components who have been all Igbo merchants with their retailers situated at Ibrahim Taiwo street space whereas three Yoruba merchants/judgment debtors included a vendor in telephone equipment, Dealer and one other offering Instructional Providers, additionally at Ibrahim Taiwo Highway.

“The Service has adopted a non-discriminatory coverage on prohibition of Associations on evaluation and assortment of private earnings tax in compliance with related provisions of the federal regulation which is the Private Revenue Tax Act, 2011 (as amended. The Service is not going to be a part of points with the writer and cohort over points which might be already pending for adjudication earlier than a courtroom of competent jurisdiction as doing identical will probably be Sub Judice.

“Towards this background, and as a good Company that firmly believes within the ideas of the rule of regulation and judicial course of, we might not permit anybody to tug the Service’s hard-earned repute within the mud.

“We advise ICIR and people behind the unpatriotic publication to chorus from heating up the polity by subjecting issues already earlier than a reliable courtroom to a courtroom of public opinion the place gamers typically deliberately select which info to state and which info to suppress within the pursuit of their agenda. We urge the platform to chorus from interfering with the constitutional powers and capabilities of the Court docket”, it mentioned.