Need extra housing market tales from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

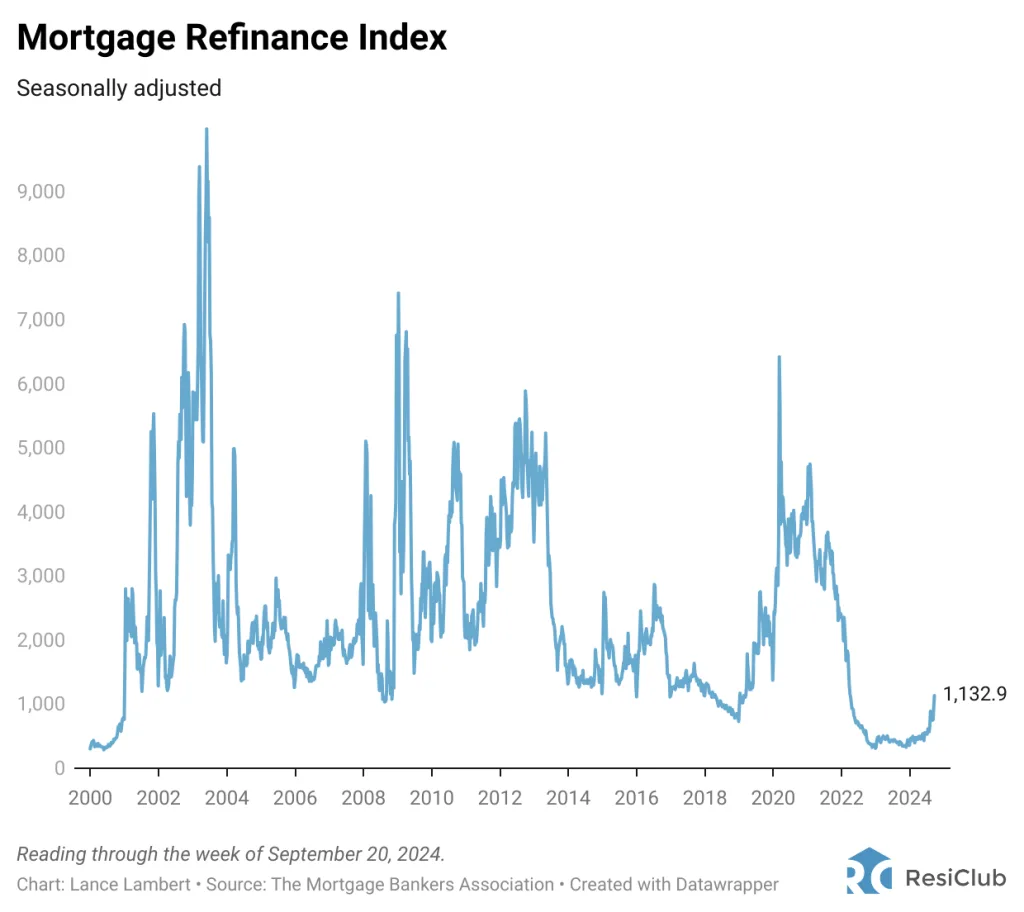

Final week, the Mortgage Bankers Affiliation reported one other enhance in its weekly refi index, as refinancing continues to slowly achieve traction. Provided that the common 30-year fixed-mortgage charge, as tracked by Mortgage Information Each day, has dropped from this 12 months’s excessive of seven.52% in April to six.25% as of September 25, some debtors who secured 7.0% to eight.0% charges over the previous 24 months are making the most of the latest charge dip for aid.

Right here’s how the Mortgage Refinance Index studying for the third week of September compares to that of earlier years.

2018: 947

2019: 1,928

2020: 3,580

2021: 3,391

2022: 588

2023: 415

2024: 1,133

The latest refinancing soar raises the query: How a lot room does refi, given present mortgage charges, really need to climb?

Provided that 76% of excellent mortgage debtors have an interest rate below 5.0%, the pool of potential conventional refis will doubtless have a decrease ceiling this cycle. (Many specialists throughout the business agree, some suggesting instead that home equity loans could see a resurgence.)

To acquire a extra exact estimate of potential refinancing exercise, ResiClub reached out to Intercontinental Change.

Intercontinental Change—a monetary providers large that owns the New York Inventory Change and in 2023 accomplished its purchase of housing finance giant Black Knight for $11.9 billion—has a proprietary calculation to estimate what number of mortgage debtors, primarily based on their underlying charges and present charges, are “within the cash” for a possible refinance.

To be “within the cash,” a mortgage borrower’s present rate of interest should be at the least 0.75 proportion factors (75 foundation factors) above the 30-year fixed-mortgage charge.

Again in July 2021, when the common 30-year fixed-mortgage charge was 2.80%, 25.2 million mortgage debtors have been “within the cash” for a refi. By June 2024, when the common 30-year fixed-mortgage charge was 6.87%, that quantity was simply 1.3 million.

As of September 17, 2024, when the common 30-year fixed-mortgage charge was 6.07%, that quantity was as much as 4.2 million.

Massive image: The latest dip in mortgage charges has unlocked some potential refinances, serving to to elevate refis off their ultralow ranges over the previous two years. Nonetheless, as of September 2024, the overall quantity isn’t substantial—particularly in comparison with previous refinance booms.

Over the approaching 12 months, most mortgage charge forecasters anticipate a slight drop in mortgage charges.

Right here’s the forecast for the common 30-year fixed-mortgage charge in This fall 2025:

Mortgage Bankers Affiliation: 5.80%

Fannie Mae: 5.70%

Wells Fargo: 5.55%

Moody’s/Mark Zandi: 5.50%

If these forecasts are directionally right, it might unlock some extra potential refis.