Need extra housing market tales from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

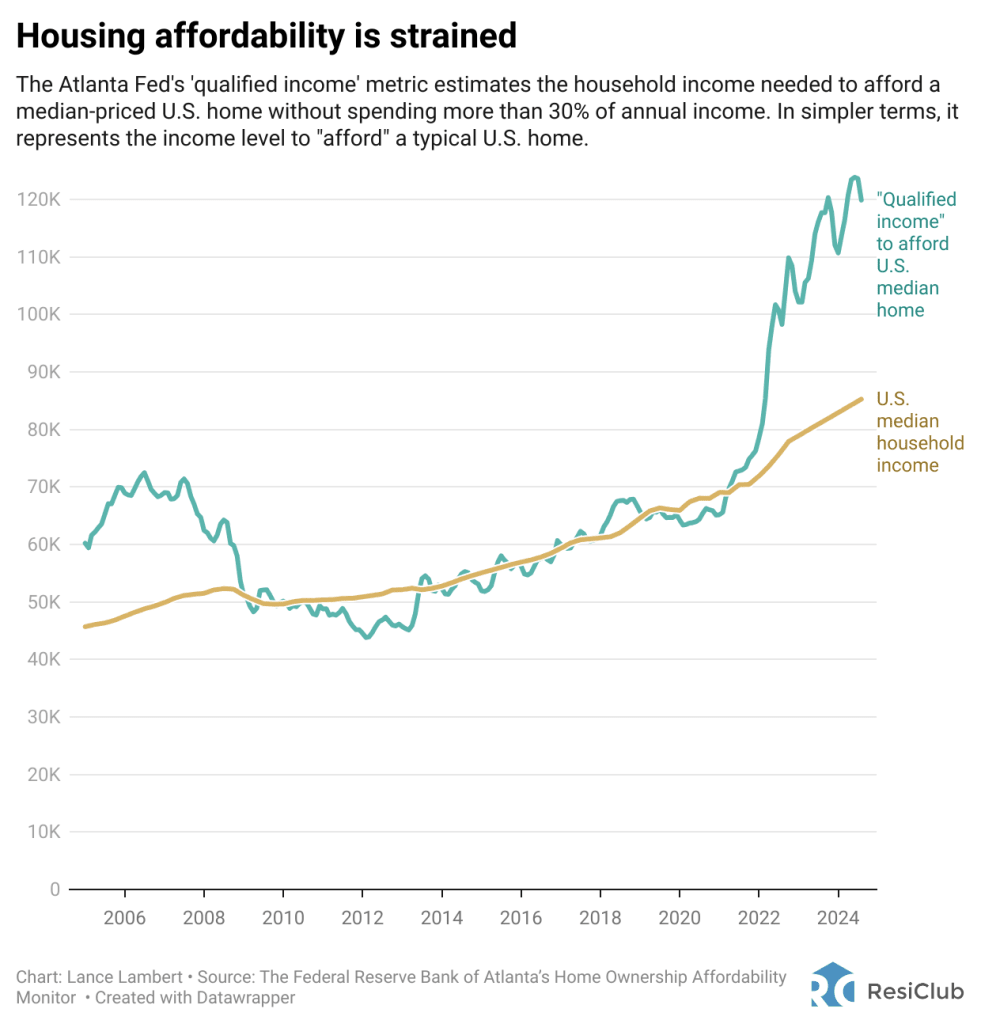

Over the previous few years, we’ve witnessed the fastest-ever deterioration in housing affordability. To know the present affordability pinch, simply take a look at the up to date evaluation printed by the Federal Reserve Bank of Atlanta just lately.

The U.S. median family earnings jumped from $65,925 in January 2020 to $85,255 in August 2024. Over that very same interval, nevertheless, the “certified earnings” essential to afford the U.S. median house went from $64,257 to $119,870.

Click here to view an interactive model of the chart under.

In different phrases, the U.S. median family earnings elevated 29.3% since January 2020. However the earnings wanted to maintain up with the rise in prices to personal a median-priced U.S. house went up by 86.6%.

Through the pandemic housing increase, housing demand surged quickly amid ultralow rates of interest, stimulus, and the distant work increase. Federal Reserve researchers estimate “new building would have needed to enhance by roughly 300% to soak up the pandemic-era surge in demand.”

Not like housing market demand, housing supply isn’t as elastic and may’t ramp up as shortly. Because of this, the heightened demand drained the market of energetic stock and overheated house costs. U.S. home prices in July 2024 had been a staggering 53.4% above January 2020 ranges.

That overheated house value progress, coupled with the following mortgage-rate shock—with the average 30-year fixed-mortgage rate leaping up from 3.0% to over 6.5%—has created the fastest-ever deterioration in housing affordability.