After a number of years of profitable day buying and selling, Umar Ashraf discovered himself in search of software program to plan, observe, and consider his trades.

However, he says, when he seemed on the commerce journaling merchandise obtainable about 4 years in the past, he didn’t discover any that totally met his wants. Ashraf needed options to assist him higher consider the small print of his trades, like running profit-and-loss data that will assist him perceive value fluctuations and threat over the course of, say, shopping for and promoting a inventory, not simply how a lot he in the end made or misplaced.

“it’s very straightforward for me to take a look at trades and say, ‘Oh, nicely, you understand, I made $500, nice,’” he says. “However once I go deeper, I’m like, ‘nicely, I used to be down three grand at one level. This isn’t actually an excellent commerce.’”

Ashraf determined to develop his personal software program package deal with options he and different day merchants would need, at first working with an company to deal with the precise coding, since he didn’t have a background in software program improvement. After some false begins led him to rent a crew and produce the operation in home with himself as CEO, he created what’s now known as TradeZella, a software program package deal first launched in early 2022.

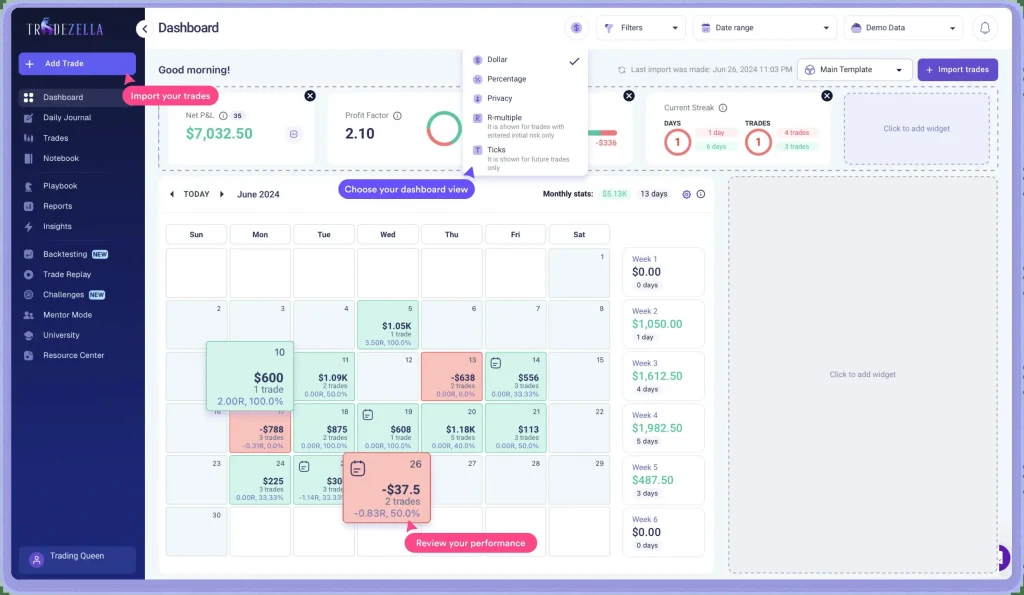

The software program connects to in style brokerages, letting prospects robotically import their commerce information involving inventory, futures, crypto, and international trade transactions. Then, they’ll examine metrics to know and plan trades round threat and reward, add their very own notes to explicit trades for future reference, or visually replay trades to totally perceive how they carried out and what the market was doing on the time. Prospects may also use a backtesting function to evaluate how potential trading strategies would have labored prior to now, getting a way of how worthwhile and dangerous they could be—and getting a way of when it would make sense to use them sooner or later.

“Should you can undergo the previous 4 years of information with that one technique now, when tomorrow or the subsequent week that technique presents itself, you’ve practiced sufficient for you to have the ability to learn it in actual time,” Ashraf says.

Merchants who want to swap methods can reap the benefits of a “mentor mode,” which lets customers give different folks restricted entry to their coaching information to supply suggestions. There’s additionally a set of webinars and educational movies that the corporate calls Zella College, providing suggestions and recommendation about buying and selling and utilizing the software program.

“Buying and selling is an business the place somebody can open up their account tomorrow, take a commerce within the span of 10 minutes, and there’s no barrier of entry,” says Ashraf. “So folks don’t know the correct issues to do to deal with buying and selling like a enterprise.”

The enterprise was fully bootstrapped and is now worthwhile (even using two of Ashraf’s sisters), Ashraf says, providing basic plans advertised at $24 monthly and premium plans with extra options beginning at $33 monthly. The software program improvement course of has additionally gotten extra refined over time, with extra formal planning and coding sprints, and capability to course of function requests from prospects.

Thus far, Ashraf’s largely promoted the enterprise by means of phrase of mouth and thru his social media channels, together with a YouTube channel the place he posts buying and selling recommendation movies to more than 750,000 subscribers and an X account that mixes trading maxims, TradeZella updates, and posts highlighting Ashraf’s success as he surprises one sister after one other with luxury vehicles.

However whereas such posts may appear to encourage extra adventurous buying and selling, Ashraf says his firm’s software program can truly assist merchants higher perceive their threat profiles and, by reminding them of their missteps, assist them keep away from overly dangerous transactions.

“ you’re gonna add your trades to this platform, and also you don’t need to have silly trades, so psychologically, you’re going to be held accountable,” he says.