Getty Photographs

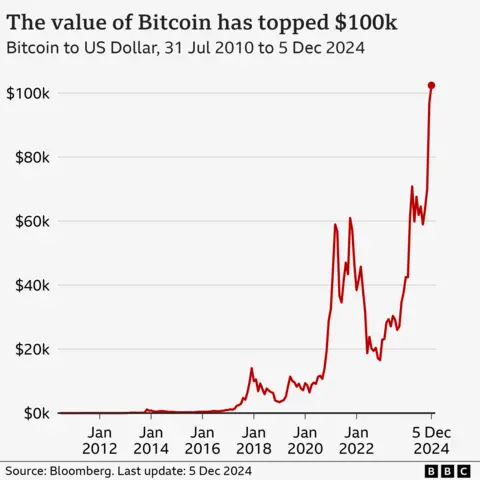

Getty PhotographsBitcoin’s worth has blasted by means of a much-anticipated threshold, reaching greater than $100,000 for the primary time within the early hours of Thursday morning.

The world’s largest cryptocurrency rose to round $103,400 shortly after 04:00 GMT on Thursday, earlier than falling barely.

Its worth has been making positive factors all through 2024 – surpassing earlier all-time highs set earlier within the yr after former president Donald Trump won the US Election in November.

Dan Coatsworth, funding analyst at AJ Bell described it as a “magic second” for the cryptocurrency and mentioned the newest “frenzy” had a transparent hyperlink to Trump.

The president-elect has beforehand pledged to make the US the “crypto capital” and “Bitcoin superpower” of the world, serving to to push Bitcoin’s worth larger.

It broke by means of the $100k barrier after Trump mentioned he would nominate former Securities and Trade Fee (SEC) commissioner Paul Atkins to run the Wall Road regulator.

Mr Atkins is seen as being way more pro-cryptocurrency than the present head, Gary Gensler.

It had led to hypothesis about how a lot larger Bitcoin might rise. Nonetheless issues additionally stay over the digital forex’s infamous volatility.

“Lots of people have gotten wealthy from the cryptocurrency hovering in worth this yr, however this high-risk asset isn’t appropriate for everybody,” mentioned Mr Coatsworth.

“It’s unstable, unpredictable and is pushed by hypothesis, none of which makes for a sleep-at-night funding.”

The Trump impact

Throughout the US presidential election marketing campaign, Trump sought to attraction to cryptocurrency traders with a promise to sack Gary Gensler – chair of the US monetary regulator the Securities and Trade Fee (SEC) – on “day one” of his presidency.

Mr Gensler’s strategy to the cryptocurrency sector has been decidedly much less pleasant than Trump’s.

He told the BBC in September it was an trade “rife with fraud and hucksters and grifters”.

Beneath his management, the SEC introduced a file 46 crypto-related enforcement actions in opposition to corporations in 2023.

Mr Gensler mentioned in November he would step down on 20 January – the day of Trump’s inauguration.

The selection of Paul Atkins to switch him on the helm of the SEC has been welcomed by crypto advocates.

Mike Novogratz, founder and chief government of US crypto agency Galaxy Digital mentioned he hoped the “clearer regulatory path” would now speed up the digital forex ecosystem’s entry into “the monetary mainstream.”

Not like different currencies

Bitcoin has seen fewer drastic falls in worth throughout 2024 than in earlier years.

In 2022 its worth fell sharply under $16,000 after crypto alternate FTX collapsed into bankruptcy.

A variety of key occasions in addition to Trump’s victory within the election have helped increase investor confidence that its worth will preserve going up.

The SEC approved several spot Bitcoin exchange traded funds (ETFs) permitting big funding corporations like Blackrock, Constancy and Grayscale to promote merchandise primarily based on the worth of Bitcoin.

A few of these merchandise have seen billions of {dollars} in money inflows.

However its potential to all of the sudden plummet in worth serves as a reminder that it’s not like orthodox currencies – and traders don’t have any safety or recourse in the event that they lose cash on Bitcoin investments.

Carol Alexander, professor of finance at Sussex College, informed BBC Information that concern of lacking out (FOMO) amongst youthful folks will see Bitcoin’s worth proceed to rise.

However she added that whereas this might spark an increase in different cryptocurrencies, most of the youthful traders investing in meme cash are dropping cash.