Branded is a weekly column dedicated to the intersection of promoting, enterprise, design, and tradition.

When Elliott Hill begins his stint as the brand new chief government of Nike subsequent week, he would possibly contemplate stealing a transfer from longtime rival Adidas—and speak some trash about his personal firm.

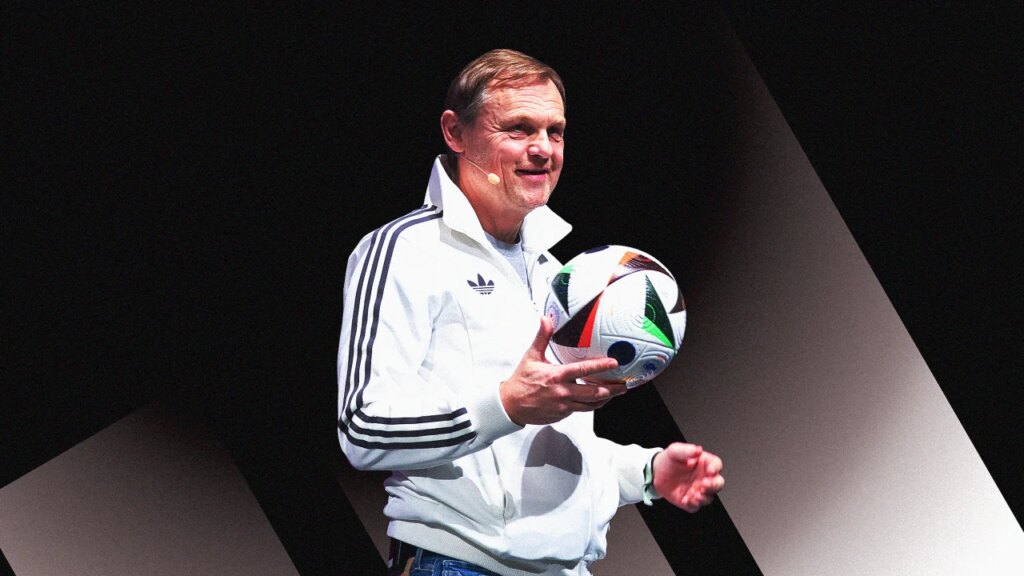

Adidas was saddled with a number of issues (together with the messy dissolution of its partnership with Yeezy and ensuing stock overload) when Puma veteran Bjørn Gulden took the reins in early 2023. Many had an unabashedly crucial tackle the corporate, most notably Bjørn Gulden himself. “The numbers communicate for themselves,” he said in an organization press launch, not lengthy after taking excessive job. “We’re at the moment not performing the way in which we should always.” Gulden granted that Adidas had “the components to achieve success” however prompt they had been in disarray. “We have to put the items again collectively once more,” he mentioned, “however we’d like a while.”

He referred to the yr forward as a “reset” interval—“a yr of transition to set the bottom to once more be a rising and worthwhile firm.”

It’s that final bit that offers away the actual level of dunking by yourself model when in comeback mode: You need to be judged in opposition to the worst attainable baseline, not the much more spectacular efficiency from again earlier than the issues set in. Partly, this follow—name it self-negging—is a basic under-promise and over-deliver technique: Get expectations low sufficient and also you appear to be a rock star for getting the fundamentals proper.

And in a stretch that’s seen loads of CEO churn, because of disappointing performances, new chief executives haven’t been shy about inheriting negatives. Starbucks has “drifted from [its] core,” its new CEO Brian Niccol wrote in an open letter final month. The expertise “can really feel transactional, menus can really feel overwhelming, product is inconsistent, the wait too lengthy or the handoff too hectic.” He introduced a “first hundred days” plan to go to U.S. areas and take steps towards a back-to-the-core effort.

Purple Lobster, lately rising from chapter, has closed greater than 100 areas and cycled via a number of CEOs. “There’s a gap to climb out of, for positive,” its new chief government Damola Adamolekun told CNN earlier this month. The 35-year-old former P.F. Chang CEO has to this point introduced solely “incremental adjustments” however, not surprisingly, has confused that the chain’s now notorious endless-shrimp particular (since discontinued) made little monetary sense and induced “a whole lot of chaos.”

The technique doesn’t all the time work, and might simply come throughout as merely scapegoating previous administration or fallout from C-suite knife-fighting (see Bob Iger’s return to the top job at a beleaguered Disney in 2022, for instance). But when share worth is any indicator, Adidas executed nicely on shopping for time to show it may execute higher in operating its precise enterprise.

In Might, just some months into Gulden’s tenure, Adidas’s progress was blended (it nonetheless held much more inventory than analysts expected), however setting a low bar was already serving to the corporate’s inventory worth, which has now risen about 28% for the reason that starting of the yr. For his half, Gulden didn’t precisely elevate the bar a lot at his first earnings name with buyers in April, as an alternative saying that arch-rival Nike had achieved a greater job with its product combine.

No matter Gulden’s motivation was, that sounds beneficiant looking back: Nike is the one going through large challenges beneath a brand new chief. A pandemic-era transfer towards extra direct gross sales on the expense of retail partnerships has proved rocky. And rival up-and-comers together with Hoka and On have constructed devoted athlete audiences and resonant manufacturers—aka, conventional Nike strengths. It’s no secret that the corporate has suffered via “a moribund patch,” as Fast Company reported again in Might, marked by flattening gross sales and layoffs. After information broke in September that Hill would exchange CEO John Donahue, the value of Nike shares immediately jumped about 8%, earlier than ultimately sliding again down.

Nike has postponed its deliberate November investor day occasion, so it’s not clear once we’ll hear from Hill in a considerable method. However, whereas he appears to be a popular choice, he could also be clever to make his opening notes downbeat: underscoring the depth of the challenges reasonably than promising fast options. It could even be clever to take action prior to the corporate’s subsequent earnings report within the new yr: Setting expectations isn’t nearly predicting the place you’ll end, however defining the beginning line.

Because it turned out, Adidas actually did have a reasonably awful 2023, posting its first annual loss in more than three decades. Whereas it appears to have labored via the Yeezy challenge, the corporate nonetheless expects North American income to say no in 2024. Nonetheless, Guldin may say with a straight face that the yr “ended higher than what I had anticipated.” Properly, after all, it did: In any case, he indicated that he anticipated the worst.

However Guldin wasn’t precisely bragging, calling the outcomes “by far not ok.” Even so, the Adidas share worth is up 90% since he began. Chalk that as much as the ability of (self-directed) trash speak.