A brand new report has proven that to justify the large price related to the unreal intelligence (AI) infrastructure build-out, AI firms want to begin producing $600 billion in annual income – greater than all the particular person GDPs of superior economies just like the United Arab Emirates (UAE), Singapore, Norway and Austria.

As Nvidia moved (briefly) into the position of the most valuable company in the world, questions have began to come up about how AI firms are going to show the large infrastructure funding into revenue.

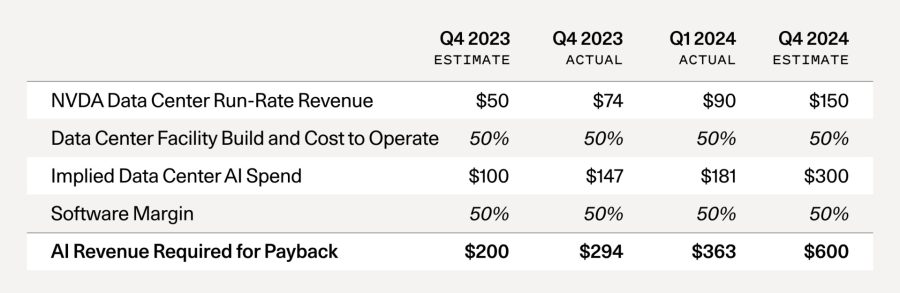

David Cahn, an analyst at Sequoia Capital (which has beforehand invested in Elon Musk’s xAI) shared a report final week suggesting that a problem he highlighted final September has grown from a $200 billion drawback right into a $600 billion one.

The hovering prices of the AI business

Cahn checked out Nvidia’s run-rate income forecast and estimated that the GPUs account for 50% of the associated fee, so doubled the determine to account for power, buildings, workers, and so forth. That determine is then doubled once more to permit for a 50% gross margin. This doesn’t account for any income share for cloud distributors and middlemen.

Nvidia has reported that roughly half of its information heart income comes from massive cloud suppliers (Amazon, Microsoft, and Google, to call a couple of) with Microsoft alone accounting for 22% of its This fall 2024 income.

Regardless of warnings that return on the heavy funding will take time, Meta continues to invest heavily in growing its AI capability, with expenditure forecast to succeed in $40 this 12 months.

Amazon has also announced its plans to proceed to take a position closely into AI, with a deliberate $150 billion spent over the following 15 years on information facilities.

Additional fuelling the large will increase is Nvidia’s continued innovation in its chips. The B100 chip which it launched earlier this year guarantees 2.5 occasions the efficiency at solely a 25% increased worth and appears more likely to drive additional funding in infrastructure as tech giants scramble to maintain up with one another.

At current, OpenAI is dominating the lion’s share of cash in AI firms. The Information revealed that the corporate behind ChatGPT has elevated its income to $3.4 billion, however its domination has not stopped continued funding by different firms.

Cahn’s conclusion is that Meta’s expectations of an extended street forward are nearer to actuality than anybody hoping to make a fast revenue in AI ventures.

Featured picture credit score: generated by Ideogram