The Lagos Chamber of Commerce and Business has projected a discount in rates of interest within the coming months, as inflation reveals indicators of easing.

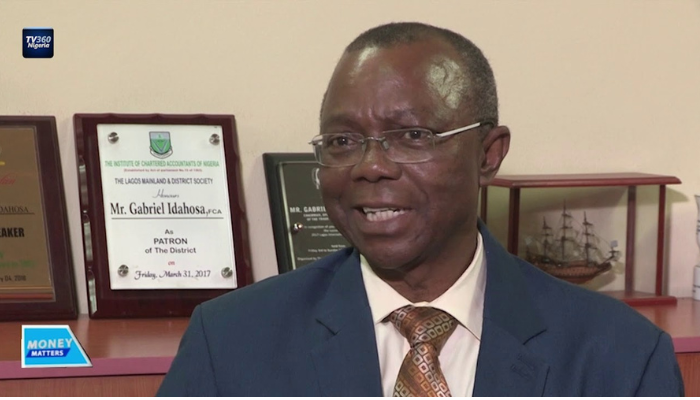

Talking at a press briefing for the chamber’s 2025 outlook on Thursday in Lagos, LCCI President Gabriel Idahosa famous that the Financial Coverage Committee of the Central Financial institution of Nigeria is prone to undertake an easing posture quickly.

“Whereas we venture that the MPC might start to ease rates of interest throughout the subsequent few months on the again of a possible decrease inflation charge, we should warning the federal government in opposition to shifting its focus away from curbing inflationary pressures,” Idahosa mentioned.

The Chamber expressed concern over the affect of excessive rates of interest on the non-public sector, which it described because the spine of Nigeria’s economic system.

The present 27.5 per cent financial coverage charge, in response to the LCCI, has pushed up borrowing prices, discouraged investments, and diverted funds to authorities treasuries.

“Fee hikes alone won’t curb inflation with out addressing the challenges in the actual sector,” Idahosa emphasised, urging the federal government to deal with inflation by supporting agriculture and manufacturing.

On inflation, which rose to a close to 30-year excessive of 34.8 per cent in December 2024, Idahosa attributed the rise to insecurity, transport prices, and local weather change.

Nonetheless, he stays optimistic about ongoing coverage reforms. “If the federal government harmonises its fiscal and financial devices to deal with agricultural manufacturing prices and insecurity, inflationary pressures might quickly start to abate,” he added.

The Chamber additionally criticised the nation’s floating alternate charge regime, noting the naira’s 40.9 per cent depreciation in opposition to the greenback in 2024.

Idahosa attributed the decline to speculative actions and a mismatch in international alternate provide and demand. He urged the federal government to spice up foreign exchange inflows and guarantee transparency available in the market to stabilise the naira.

Whereas commending the 2025 ‘Finances of Restoration,’ the LCCI known as for sturdy implementation to satisfy its formidable targets. The N34.82tn income projection, Idahosa mentioned, underscores the necessity for improved tax reforms, digital transparency, and the mixing of the casual sector into the tax internet.

The Chamber additionally really helpful reforms in agriculture, manufacturing, and the Micro, Small and Medium Enterprises sector to reinforce productiveness. “MSMEs stay the spine of Nigeria’s economic system. We urge the federal government to increase entry to credit score at concessionary charges and introduce technology-driven lending platforms,” Idahosa mentioned.

LCCI’s optimism for 2025, nonetheless, hinges on the federal government’s means to implement focused interventions, deal with structural bottlenecks, and foster alignment between financial and financial insurance policies. “With proactive reforms, Nigeria can navigate its financial challenges and unlock sustainable progress,” Idahosa concluded.

The Chamber reiterated its dedication to advocating a stronger economic system and a extra business-friendly surroundings, urging the media to proceed amplifying its coverage suggestions.