Unlock the Editor’s Digest without cost

Roula Khalaf, Editor of the FT, selects her favorite tales on this weekly e-newsletter.

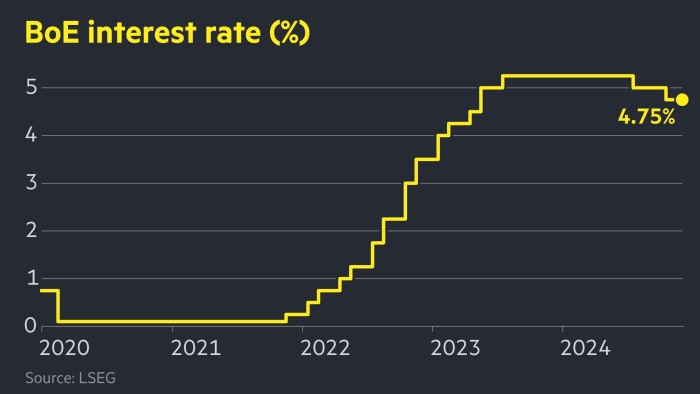

The Financial institution of England has saved rates of interest on maintain at 4.75 per cent because it seeks to deal with each cussed inflation and lacklustre development.

In a cut up choice, most members of the Financial Coverage Committee warned that latest will increase in wages and costs had “added to the danger of inflation persistence”, dampening hopes of speedy price cuts in 2025.

“We expect a gradual method to future rate of interest cuts stays proper,” stated Andrew Bailey, BoE governor. “However with the heightened uncertainty within the economic system, we will’t decide to when or by how a lot we are going to minimize charges within the coming yr.”

He added that the BoE wanted to verify it might meet its “2 per cent inflation goal on a sustained foundation”.

The MPC’s choice, which was according to forecasts from economists polled by Reuters, comes a day after information confirmed that UK inflation rose to 2.6 per cent final month from 2.3 per cent in October.

However three out of the 9 MPC members — deputy governor Dave Ramsden, Alan Taylor and Swati Dhingra — voted for a quarter-point discount due to sluggish demand and a weaker labour market.

BoE employees now anticipate zero development within the ultimate quarter of this yr, weaker than forecast in November.

“Most indicators of UK near-term exercise have declined,” the central financial institution stated on Friday.

It added that dangers to world development and inflation from geopolitical tensions and commerce coverage uncertainty had “elevated materially” — an obvious reference to US president-elect Donald Trump’s plans to extend tariffs on imports to the US.

Sterling and gilt yields fell barely after the broadly anticipated maintain. The pound dipped to $1.260 after the BoE’s announcement, although it was nonetheless up 0.2 per cent on the day.

The yield on rate-sensitive two-year authorities bonds fell barely to 4.46 per cent.

Merchants nonetheless anticipate the BoE to make two quarter-point cuts subsequent yr — the identical as instantly earlier than Thursday’s choice.

“The voting was extra dovish than the market was anticipating, suggesting it has gone too far lately to cost out price cuts for subsequent yr,” stated Lee Hardman, MUFG’s senior foreign money analyst.

The market’s present expectation of two quarter-point price cuts subsequent yr compares with the 4 it anticipated as lately as October.

The BoE minimize charges by 1 / 4 level at its earlier assembly in November, however signalled on the time that one other minimize was unlikely till 2025. It has minimize charges twice in 2024.