If staff reject Boeing’s provide for a 3rd time, it’ll plunge the agency into additional monetary peril, uncertainty.

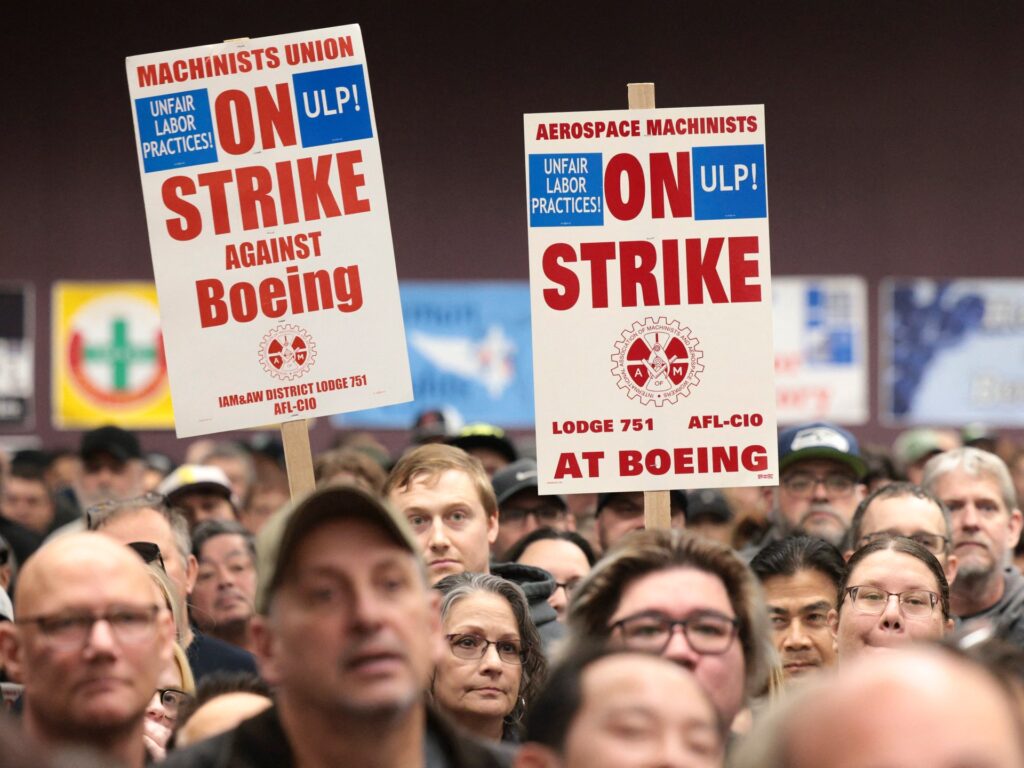

Unionised manufacturing unit staff at Boeing are voting on whether or not to simply accept a contract provide or to proceed their strike, which has lasted greater than seven weeks and shut down manufacturing of most Boeing passenger planes.

A vote to ratify the contract on Monday, the eve of Election Day, would clear the best way for the foremost United States producer and authorities contractor to renew aeroplane manufacturing. If members of the Worldwide Affiliation of Machinists and Aerospace Employees vote to reject Boeing’s provide for a 3rd time, it’ll plunge the aerospace big into additional monetary peril and uncertainty.

In its newest proposed contract, Boeing is providing pay raises of 38 % over 4 years, plus ratification and productiveness bonuses. IAM District 751, representing Boeing staff within the US Pacific Northwest, endorsed the proposal, which is barely extra beneficiant than the machinists voted down nearly two weeks ago.

“It’s time for our members to lock in these good points and confidently declare victory,” the district leaders mentioned in scheduling Monday’s vote. “We imagine asking members to remain on strike longer wouldn’t be proper as now we have achieved a lot success.”

Union officers mentioned they suppose they’ve gotten all they will via negotiations and a strike and that if the present proposal is rejected, future provides from Boeing could be worse. They count on to announce the results of the vote late Monday.

Key points

Boeing says the typical annual pay for machinists is $75,608 and would rise to $119,309 in 4 years beneath the present provide.

Pensions have been a key challenge for staff who rejected the corporate’s earlier provides in September and October. In its new provide, Boeing didn’t meet their demand to revive a pension plan that was frozen practically a decade in the past.

If machinists ratify the contract now on the desk, they may return to work by November 12, in line with the union.

The strike began September 13 with an awesome 94.6 % rejection of Boeing’s provide to lift pay by 25 % over 4 years – far lower than the union’s unique demand for a 40 % wage enhance over three years.

Machinists voted down one other provide – 35 % raises over 4 years, and nonetheless no revival of pensions – on October 23, the identical day Boeing reported a third-quarter loss of more than $6bn. Nevertheless, the provide acquired 36 % help, up from 5 % for the mid-September proposal, making Boeing leaders imagine they have been near a deal.

Along with barely bigger pay will increase, the brand new proposal features a $12,000 contract ratification bonus, up from $7,000 within the earlier provide, and bigger firm contributions to staff’ 401(ok) retirement accounts.

Boeing additionally promised to construct its subsequent airline airplane within the Seattle space. Union officers concern the corporate may withdraw the pledge if staff reject the brand new provide.

The strike drew the eye of the Biden administration. Appearing Labor Secretary Julie Su intervened within the talks a number of occasions, together with final week.

Unstable yr

The labour standoff – the primary strike by Boeing machinists since an eight-week walkout in 2008 – is the most recent setback in a unstable yr for the corporate.

Boeing got here beneath a number of federal investigations after a door plug blew off a 737 Max airplane throughout an Alaska Airways flight in January. Federal regulators put limits on Boeing aeroplane manufacturing that they mentioned would final till they felt assured about manufacturing security on the firm.

The door plug incident renewed issues in regards to the security of the 737 Max. Two of the planes crashed lower than 5 months aside in 2018 and 2019, killing 346 individuals. CEO David Calhoun mentioned he would step down. In July, Boeing agreed to plead responsible to conspiracy to commit fraud for deceiving regulators who accepted the 737 Max.

Because the strike dragged on, new CEO Kelly Ortberg introduced about 17,000 layoffs and a inventory sale to stop the corporate’s credit standing from being minimize to junk standing even because it handled a money crunch from the lack of enterprise. S&P and Fitch Scores mentioned final week that the $24.3bn in inventory and different securities will cowl upcoming debt funds and scale back the chance of a credit score downgrade.