Amid a difficult world monetary and funding panorama, the significance of African buyers backing home-grown enterprises has by no means been extra important. Regardless of the surge in world curiosity in Africa’s financial potential, there stays a stark hole between the funding wants of African startups and the much-needed obtainable capital. With many buyers slowing down on their investment-making impetus within the face of world market volatility, African entrepreneurs are left to grapple with the challenges of securing the capital wanted to start out and scale their companies.

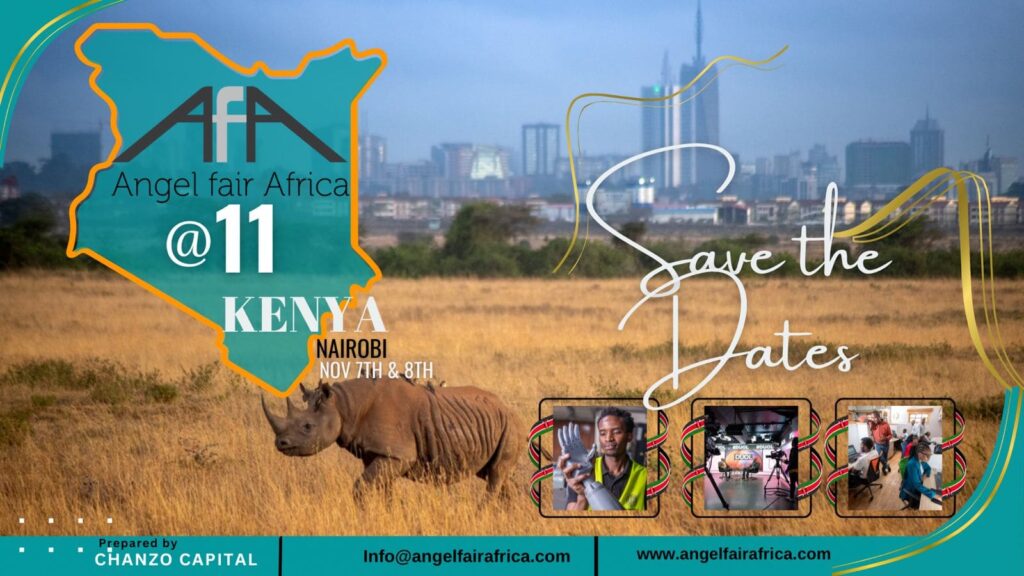

In response to the aforementioned problem, the eleventh Angel Honest Africa, scheduled for seventh and eighth November 2024, gives a possibility for African buyers to assist the continent’s future by investing within the very companies that perceive its wants and possess the potential for large-scale development and affect. The occasion which seeks to carry collectively companies and promoters from numerous sectors similar to fintech, healthtech, edtech, ecommerce, agritech and cleantech, guarantees a one in all a sort expertise each for enterprises and buyers, all of whom have tailor-made their providers for African markets.

The occasion, which might be hosted on the Two Rivers Worldwide Finance and Innovation Middle (TRFIC), has attracted partnerships from investor organisations similar to Africa Enterprise Philanthropy Alliance (AVPA), East Africa Enterprise Capital Affiliation (EAVCA), entrepreneur companions similar to iHub, Antler, Development Africa, Startup Bootcamp Africa and sponsorship from the DRK Basis. The occasion is positioned as a premier alternative that Africa’s main startup and scaleup corporations can use to pair themselves with a choose pool of buyers with the principle purpose of closing offers.

In accordance with Kanini Mutooni, Africa Managing Director of the DRK Basis, “We’re proud supporters of this occasion because of the function performs in bringing collectively early stage native and worldwide buyers in addition to entrepreneurs and facilitating deal discussions”.

Christine Maina, CEO of EAVCA was of the view that “such occasions that concentrate on early-stage founders and buyers create the pipeline that later stage buyers in our group can spend money on when they’re matured.”

Talking on earlier Angel Honest Africa engagements, Winnie Kimathi, Occasion Lead of Angel Honest Africa, stated “with 20 startups and scaleups confirmed to pitch and a plethora of seasoned buyers attending, the occasion is ready to drive tangible affect within the African funding panorama. Like earlier occasions, this one will result in direct funding and different vital partnerships that may spur development and create a ripple impact throughout the African entrepreneurial ecosystem.”